Why We Invested: Future Self to The Rescue – Earned Wage Access

2 February, 2024The democratisation of SME credit in The Philippines

7 March, 2024

Imagine being a business owner in the Philippines. You have been in operation for 15 years, generate well over $10 million in sales, your business is growing and profitable. And yet, you struggle with access to financing. 5% to 10% upfront fees? 3 to 4% monthly interest rates? 3 to 6 months processing time? Nothing other than amortising loans? 100% cash collateral? These are some of the hurdles you are likely to face as an SME owner in the Philippines seeking financing.

In fact, The Worldbank / IFC estimates that the Philippines has the highest MSME funding gap in the world, with a demand for credit of $221B versus a supply of formal credit of only $15B¹ . This is especially problematic given that MSMEs represent 99.5% of the nation’s business establishments, providing 63% of employment and accounting for 40% of the country’s GDP² .

When we started our research into SME lending in the Philippines we expected to find specific segments of borrowers that were underserved: doctors seeking medical equipment leasing, or 2nd hand car dealerships seeking working capital. To our surprise, we found virtually every SME with revenues of $20 million or less to be somewhat or severely under-banked. Overall, we identified 5 key functional areas causing inefficient capital allocation:

- Lack of ability to process: applications for loans can take up to 6 months

- Lack of model-based credit decisioning: in favour of judgement based decisioning, leading to lack of scalability and business economics

- Lack of risk-based pricing: one price fits all

- Lack of true client orientation: the majority of lending to SMEs remains in the form of fully amortising loans, with little use of, for example – automatic loan top-ups, revolving credit lines, etc.

- Lack of technology enablement: little or no technology enablement for onboarding, processing etc.

It’s not that there is a lack of market participants. The lending ecosystem in the Philippines is vast and varied, comprising 1,822 commercial banks, thrift banks, rural banks, and a multitude of non-bank lenders. Despite this abundance, the market suffers from a critical imbalance – while numerous players exist, the majority lack the scale and capabilities needed to effectively serve the diverse needs of borrowers. As a result, only a handful of top banks command the lion’s share of the market. Slicing the 1,822 licensed lenders in the Philippines by total assets³ :

- The top 4 control 54% of total banking assets (BDO, Landbank, BPI, MetroBank)

- The top 10 control 82% of total banking assets

- The top 20 control 91% of total banking assets

- The remaining 1,802 control 9% of total banking assets

The top banks run very profitable businesses providing transaction banking to large enterprises and catering to the premium consumer segment (a separate discussion for another article). There simply is very little incentive to go down the curve towards smaller clients, as the cost of underwriting remains largely the same if no technology is deployed.

In response, a thriving non-bank financial services market has emerged. This market can be roughly divided in three categories: (1) A handful of underwriters who have made significant inroads improving access to credit but altogether still account for less than 0.5% of total loans outstanding; (2) A large group of small family lenders who lend to their direct business connections, forever recycling capital; and (3) A large group of essentially payday lenders who substitute risk assessment and structuring for usury fees and rates.

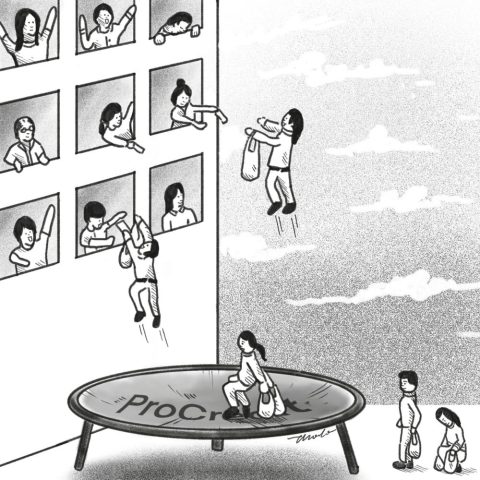

Enter ProCredit

Clearly there is room to do things differently. Between enterprise transaction banking by large commercial banks and corporate payday lending by most non-bank financial institutions, there is a multi-billion dollar opportunity for fair SME credit. A space where only a handful of lenders are currently active, but none have scaled in a way that the NBFIs (non-banking financial institutions) in India have. This is exactly the gap that ProCredit seeks to fill.

Adnan Agha, the Founder and President of ProCredit, has been on a path to fill that gap for a long time. While some founders land on their ultimate business model by trial and error, Adnan has been honing and perfecting SME lending for over 35 years.

During his career, Adnan has built and managed SME lending books in markets ranging from Pakistan, Kazakhstan, Vietnam, Korea, Nigeria, and the Philippines. We believe that it is the cumulative experience of managing risk over multiple decades, and bringing a perspective from what has and has not worked in other emerging and frontier markets, that positions Adnan extremely well to build a successful SME lender in the Philippines.

We observe three key differences with Adnan and his team.

First, credit officers are placed at the very front of the business. There are no relationship managers, only credit officers. Acknowledging that in emerging market SME lending, visiting the client and sitting down with the business owner is the key to successful underwriting is what sets ProCredit apart from its competitors.

Second, ProCredit focuses its technology efforts not on client acquisition (see point 1 above), but on building a leading back-end lending engine and data analytics capability. This is coding the team’s business logic into a technology-led engine that can shrink decision time, increase accuracy, and enable risk decisioning in near-real time.

Third, the team brings a different perspective to structuring risk at the firm level, combining bank and non-bank lending capabilities in order to provide a fuller suite of SME lending solutions to its clients in the Philippines.

Integra Partners are joined by a fantastic group of investors in this seed round. We are pleased to co-invest alongside the Menardo Jimenez Family Office, M Venture Partners, Cento Ventures, Gobi Partners, and several local angels, and look forward to supporting Adnan and his team as they build what will no doubt become an enduring and successful SME lending business in the Philippines, and perhaps beyond.

Endnotes:

¹ The WorldBank, IFC, MSME Finance Gap, “assessment of the shortfalls and opportunities in financing micro, small and medium enterprises in emerging markets”, 2017

² https://www.undp.org/philippines/publications/msme-value-chain-rapid-response-survey

³ Source: BSP

Why We Invested:

This is part of our “Why We Invested” series, where we share our thought process in the investments we have made from Integra Partners Fund II, the problems they are addressing, and what they are doing about it. You can find the rest of the series here.