Integra at a glance

2

number of flagship funds

$150m

assets under management

33

portfolio companies

$92m

distributed to founders

$345m

additional capital catalyzed

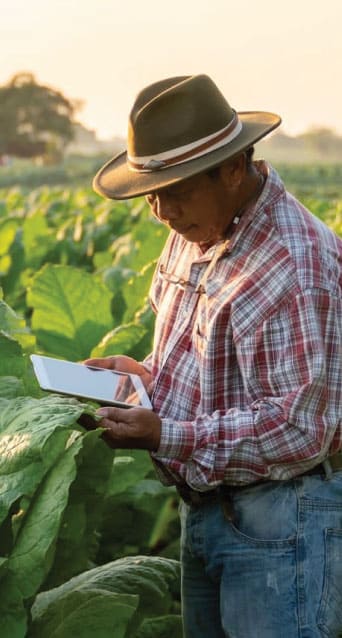

Investment Themes

Large themes catalyzed by technology and digital finance

Integra invests across five main themes that leverage technology and financial services to unlock greater monetization, creating more profitable and sustainable business models. From SME enablement and agri-food to healthcare and climate, technology provides a digital network to distribute and bundle financial offerings while innovative customer acquisition strategies ensure both businesses and end consumers are reached in a scalable and cost effective way. We believe these themes represent the largest and most relevant opportunities that not only drive investment outcomes, but also make the biggest difference for the everyday person in our countries of focus.

Framework & Strategy

How we find and evaluate investment opportunities, and support companies as they grow

01

Deal sourcing

We map our ecosystem through regular top-down market research reports and startup landscape mapping, supplemented by on-the ground knowledge from our venture partner networks, and nurture nascent opportunities through our venture partner program supported by USAID. While warm introductions work well, founders are always welcome to reach out by filling out a form on our website or through email.

02

Assessing fit

Do founders have the right experience and expertise? Does the startup have product-market fit? Does the company have scalable and repeatable sales capabilities? Is there multi-market fit for later stage companies?

03

Evaluating a startup’s impact

Through our Net Impact Framework, we measure the company's alignment to Integra’s mission to drive impact and identify potential ESG risks to be mitigated.

04

Conducting due diligence

On top of commercial and financial due diligence, we also ask companies to go through structured technology and legal due diligence processes.

05

What happens after investment

Integra works closely with our founders after investment to provide timely guidance, make relevant introductions, and cross-pollinate learnings from across the portfolio.